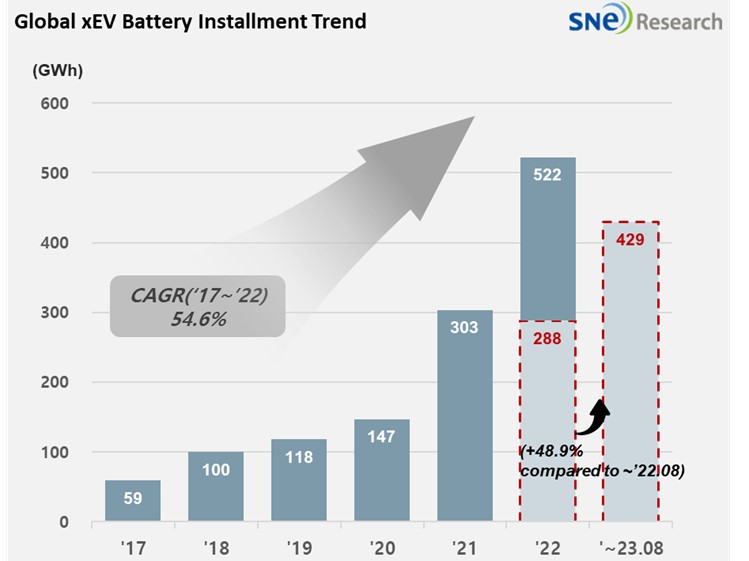

From Jan to Aug in 2023, Global[1] EV Battery Usage[2] Posted 429.0GWh, a 48.9% YoY Growth

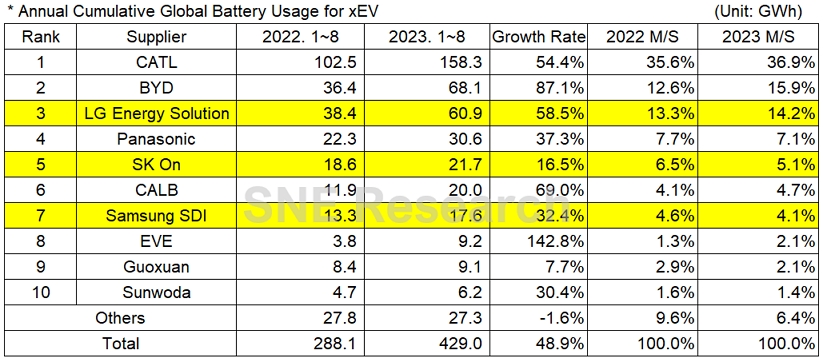

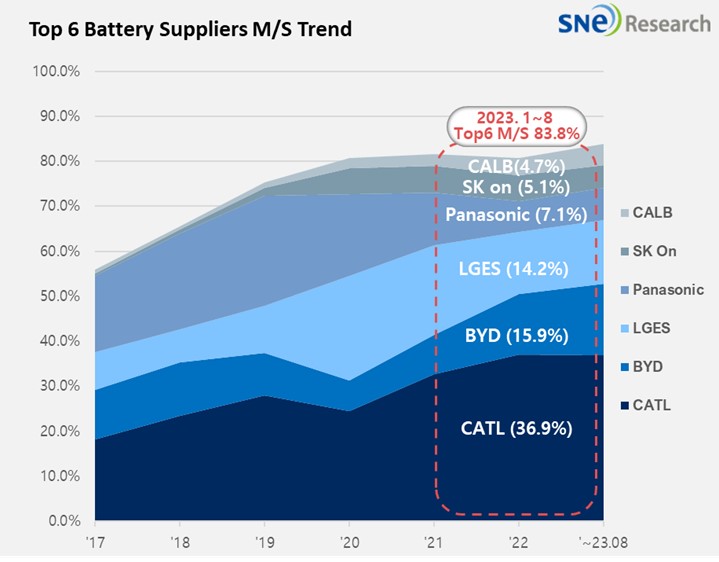

- From Jan to Aug in 2023, K-trio’s M/S recorded 23.4%

From

January to August 2023, the amount of energy held by batteries for electric vehicles

(EV, PHEV, HEV) registered worldwide was

approximately 429.0GWh, a 48.9% YoY growth.

(Source: 2023 Sep Global Monthly EV and Battery Monthly Tracker, SNE Research)

The combined market shares of K-trio companies were 23.4%, declined by 1.0%p compared to the same period of last year, but all of them showed a growth in terms of battery usage. LG Energy Solution ranked 3rd on the list, posting a 58.5%(60.9GWh) YoY growth, while SK On took the 5th position with a 16.5%(21.7GWh) growth and Samsung SDI took the 7th position with a 32.4%(17.6GWh) growth.

(Source: 2023 Sep Global Monthly EV and Battery Monthly Tracker, SNE Research)

The growth trend of K-trio was mainly affected by strong sales of electric vehicle models equipped with batteries of each company. Samsung SDI kept the growth momentum thanks to continuous sales of BMW i4/i7/iX, Audi Q8 E-Tron, Rivian R1T/R1S/EDV, and FIAT 500. SK on recorded a growth based on solid sales of Hyundai IONIQ5, KIA EV6, and Mercedes EQA/B. With a recent announcement of increases in production of Ford F-150 Lightning, its sales has grown too, possibly adding more momentum to the growth of SK On. LG Energy Solution posted the highest growth among K-trio companies, driven by favorable sales of global best-selling models such as Tesla Model 3/Y, Volkswagen ID. 3/4, and Ford Mustang Mach-E.

Panasonic, the only Japanese company in the top 10 on the list, recorded 30.6GWh, a 37.3% YoY growth. Panasonic, who is one of the major battery suppliers to Tesla, has most of its battery usage installed in Tesla models in the North American market. Particularly, Tesla Model Y, showing a sharp growth in sales compared to the same period of last year, drove the growth of Panasonic. In addition to Tesla, MAZDA also has Panasonic’s battery installed in its vehicles, and it has been reported that discussions have been going on to increase the battery supply in future.

CATL posted a 54.4% YoY growth, making it as

the only battery supplier in the world to account for more than 30% of the

global market share and thus remaining as top on the list. Particularly, CATL,

who has been trying hard to enter overseas markets, showed a growth almost doubled

from the same period of last year in Europe and North America. CATL’s battery

is installed major passenger electric vehicle models in the Chinese domestic

market such as MG ZS, MG-4, GAC Group’s Aion Y, and NIO ET5. It is also installed

in vehicles made by global major OEMs such as Tesla Model 3/Y, BMW iX, and Mercedes

EQS, continuing to show a high growth.

BYD showed a growth nearly double from the same period of last year in the Chinese market based on its high popularity. BYD achieved such popularity based on its price competitiveness through vertical SCM integration such as in-house battery supply and vehicle manufacturing. Recently, it has been rapidly expanding its market share in Asia except China and Europe mainly with its Atto 3(Yuan plus) model.

(Source: 2023 Sep Global Monthly EV and Battery Monthly Tracker, SNE Research)

These days, the growth of global EV sales has slowed down. Price of electric vehicles is pointed out as a major reason for such slowdown while the market for cost-effective, entry-model EV has been on the rise. In order to lower the ratio of battery – in fact, battery has the highest ratio among other EV components – in electric vehicle cost, many of the industry players have adopted LFP battery that has better cost competitiveness in comparison with NCM ternary battery. K-trio, that has been focusing on the development of high-performing ternary battery, are reported that they also diversified their battery development effort for entry-level EV models in accordance with an increase in demand for LFP battery. While Chinese companies, who have strength in LFP battery technology and production, have difficulties in directly entering the overseas markets due to heightened trade barriers in many countries (e.g., the Inflation Reduction Act in the US), attentions should be drawn to changes in global market shares according to LFP battery strategies carried out by the Korean battery trios.

[2] Based on battery installation for xEV registered during the relevant period.